What was 2022 like for the real estate market in Spain and what does that tell us about 2023

Everything indicates that the real estate boom that began on the Spanish market after the pandemic is coming to an end. Property sales in December 2022 fell. Spanish notaries sold 59,730 properties in the last month of 2022, a decrease of 18% compared to the previous year, according to data published by the Spanish association of notaries.

What you will find in the article:

- How were property prices in Spain in 2022?

- 2022 was the best in a decade for the mortgage sector in Spain

- Spanish primary market in 2022

- 2022 was the year of foreign investors, and the largest increase was recorded among investors from Poland

- Where did foreigners buy property in Spain in 2022?

- Why such a large increase in foreign demand in 2022?

- What are the prospects for the Spanish real estate market in 2023?

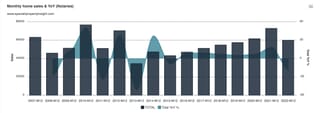

The sales curve has been trending downwards since the third quarter of last year. It went down from +36% in January 2022 to -18% in December. It should be added, however, that December sales were higher than in the corresponding month of 2019 and one of the highest in the last decade, as shown in the chart below.

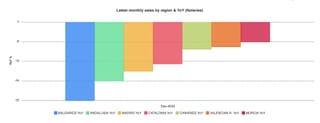

In terms of regional developments, sales fell the most in the Balearic Islands (-32%) and the lowest in Murcia (-8%), as shown in the final chart below.

How were property prices in Spain in 2022?

The average property price in Spain increased by just 0.6% in the 12 months to the end of December, ending the year at EUR 1,590/m2. In comparison, the highest average price in mid-2022 was €1,694/m2, still well below the prices of around €1,800/m2 that were common in Spain more than 15 years ago.

2022 was the best in a decade for the mortgage sector in Spain

According to data from the INE (Spanish Central Statistical Office), 30,075 loans for the purchase of real estate were registered in December, down 8.8% year-on-year and 23.5% less than in November, which is the minimum since the beginning of 2021. Despite this decline, throughout 2022, banks granted 463,614 mortgage loans, 10.9% more than a year earlier and the most since 2010.

Juan Villén, CEO of idealista/hipotecas, explains:

“2022 has undoubtedly been a very good year for the mortgage sector, although it is true that we are seeing declines over time. Those recorded in December confirm a change in the trend in mortgage financing as extremely cheap loans have disappeared from the market and the short reign of fixed interest rates seems to be coming to an end.

Villén points out that mixed-rate loans are becoming a star among mortgages:

"With the cost of fixed interest rates increasing and variable rate volatility, blended mortgages are emerging as a star tool for obtaining financing at more competitive rates, protecting themselves from rate hikes in the coming years."

In terms of absolute volume of operations, the three most significant regions are Andalusia (91,287), Catalonia (80,767) and Madrid (80,416).

What also increased in 2022 is the average amount of mortgages established on residential real estate. Their amount increased by 5.8% year-on-year to EUR 145,510, while capital borrowed by banks for the purchase of residential properties increased by 17.3% and exceeded EUR 67,460 million.

Fixed-rate mortgages were the hero of 2022 and recorded the best year in their history. Although they have lost some market share since the summer, never before have so many fixed-rate mortgages been signed in Spain as in 2022. To be exact, more than 328,000 have been registered, about 80,000 more than in 2021.

However, experts say that the market trend is changing due to the increase in interest rates and that currently mixed loans are the most desirable ones.

Spanish primary market in 2022

According to data from the Ministry of Transport, Mobility and the Urban Agenda, between January and November 2022, the number of new building permits reached 100,800, 1.6% more than in the corresponding period of the previous year, when 99,194 were registered.

Of these 100,800 new building permits, 23,908 were for single-family houses, 29% more than a year ago, and 76,848 were for multi-family buildings, 28.25% more than between January and November 2021.

During these eleven months of 2022, 44 permits were also issued for other types of buildings that are not single-family houses or blocks of flats, which is 46.6% more than a year ago.

2022 was the year of foreign investors, and the largest increase was recorded among investors from Poland

The latest figures show that in 2022, 94,481 Spanish residential properties were sold to foreign buyers, an increase of 55% over 2021. Local demand increased by 9% to 551,760 properties. This means a total demand of 646,241 properties, an increase of 14% compared to 2021.

As a result of a stronger increase in foreign than local demand, the share of foreign customers in the market increased to a record level of 14.6% in annual terms.

Sources of foreign demand in 2022

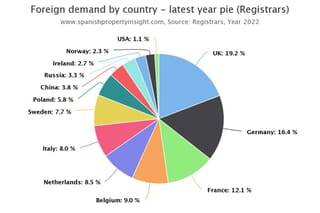

Counting the countries from which buyers come to Spain seeking for second homes, relocations and Golden Visa investments, the UK was again the largest market with 9,837 purchases, representing 19.2% of that market and up 47% year on year by year. Germany is next with 8,416 buys and 16.4% of the market, up 44%.

The largest increase was recorded among Polish investors (+161%) , undoubtedly "encouraged" by the invasion of Ukraine, followed by Dutch (+88%), Norwegian (+71%) and Irish (+65%) investors. Russian demand increased by 30% to 1,709 transactions and Ukrainian demand by 110% to 1,554.

Where did foreigners buy property in Spain in 2022?

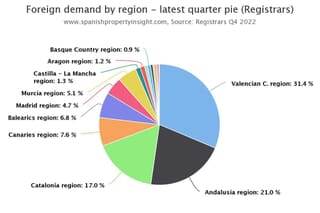

To answer this question, we need to look at the fourth quarter of 2022 data, as the regional breakdown is not yet available for the full year.

The Valencian Community, home to the Costa Blanca and the Costa del Azahar, was the most popular destination with 31.4% market share (6,922 sales), followed by Andalusia, home to the Costa del Sol, with 21% (4,626 sales) and Catalonia with 17% (3,745 sales). These three regions account for almost 70% of the foreign demand for real estate in Spain.

Looking at the growth of foreign demand by region, the small market of Galicia was number one with an increase of 132% in Q4 2022, but the biggest growth of the large market was in the Valencia region, with 34%, followed by Catalonia with 33%. Andalusia achieved a modest 13%. The largest decline was in the Balearic Islands (-19%), which was probably due to the lack of properties for sale, high prices, the highest property sales taxes in Spain and the actions of the Balearic Regional Government to make foreign investors feel unwelcome there.

Why such a large increase in foreign demand in 2022?

No doubt some remnants of pent-up demand due to the pandemic have turned into sales in 2022, but the scale of the growth suggests there is more to it. There are other factors behind the dramatic increase in foreign demand for property in Spain in the past year, including low interest rates and the perceived appeal of Spanish property as an investment in turbulent times by international buyers.

What are the prospects for the Spanish real estate market in 2023?

Spain climbs up in the ranking of the most attractive European countries for investors in 2023, taking fourth place there. This is an increase of three places from the previous year, when it was ranked seventh. Spain is second only to Great Britain, Germany and France. Madrid and Barcelona are also improving, ranking fifth and sixth respectively in the top ten European cities to invest in, according to CBRE's latest Investor Intentions Survey 2023.

Only Spain and Germany have more than one city in this ranking, which proves that the outlook for the Spanish real estate sector is good. In addition, both cities moved up positions compared to the previousyear. Madrid moved up from sixth to fifth while Barcelona moved up from ninth to sixth.

Southern Europe is particularly active, with several European cities including Madrid, Barcelona and Lisbon among the markets that will generate the most interest in 2023.

The survey shows that investors maintain good prospects for 2023. Half of them expect an increase or maintenance of investment activity throughout the year. Among the main challenges, they point to are fears of a recession, divergent expectations between buyer and seller, and tightening credit conditions. High inflation is also one of the biggest challenges for investors in 2023.

Sources: Spanish Property Insight, Idealista